TRACK RECORD / OUR DEALS

Featured In

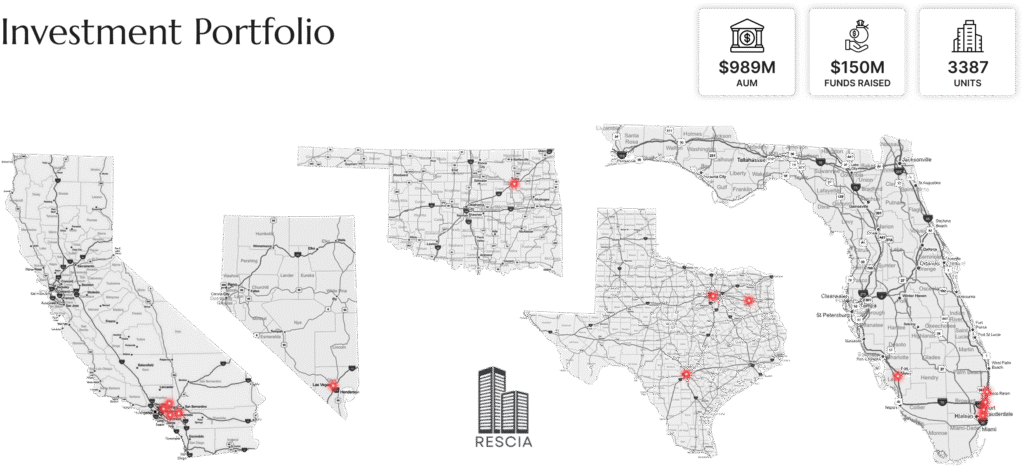

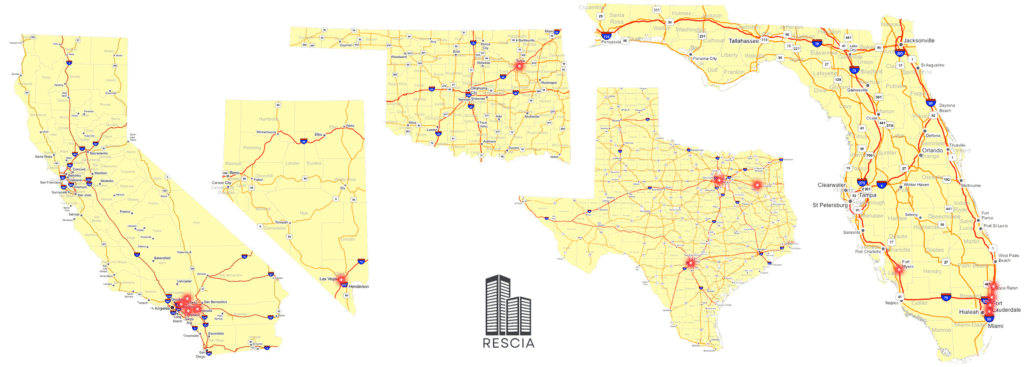

Proven Performance. Measurable Results.

For over two decades, we’ve delivered results that speak louder than promises — building real wealth through disciplined acquisitions and strategic asset management.

- 500 M in Sales

- 3387+ Units

- 40+ Years of Experience

- 989 M current AUM

Check Out Our Recent Deals...

The Camino Portfolio

The Camino Portfolio

64 Units (Value-Add) — Las Vegas, Nevada

Status: Stabilized | Category: Class-B Asset

Well-located multifamily portfolio in a demand-driven Las Vegas submarket with strong rental fundamentals and excellent proximity to employment and retail corridors.

- Prime Class-B asset in growth market

- $250+ rental upside potential

- Light value-add upgrades planned

- Flexible exit — refinance or hold

Lynwood Portfolio

Lynwood Portfolio

28 Units (Value-Add) — Las Vegas, Nevada

Status: Stabilized | Category: Class-B Asset

Strategically located property in a supply-constrained submarket with strong demographics and cash flow performance from day one.

- Strong in-place cash flow

- Below-market rents, upside potential

- Minimal deferred maintenance

- Multiple exit strategies (1031 / long-term hold)

Culebra Commons

Culebra Commons

327 Units (Class-A) — San Antonio, Texas

Status: Active | Category: Institutional Grade

Class-A multifamily community offering exceptional operating margins and financial stability through strategic tax advantages.

- 100% property tax exemption

- 70–75% profit margins

- 40-year loan at 3.25% fixed

- Strong inflation protection

Ventura

Culebra Commons

660 Units (Class-B) — Arlington, Texas

Status: Active | Category: Value-Add Multifamily

High-quality Class-B asset in a prime Arlington location with excellent amenities and occupancy performance.

- 660-unit stabilized community

- $250+ rent headroom vs. market

- Light interior upgrades only

- Multiple long-term exit options

101 Mizner

101 Mizner

366 Units (Class-A) — Boca Raton, Florida

Status: Coming Soon | Category: Premier Asset

A premier Class-A property in one of Florida’s strongest submarkets — offering unmatched fundamentals and multiple value creation strategies.

- Best-in-class location

- Condo conversion potential

- Positive cash flow from day one

- Strong long-term appreciation outlook

Let’s Build Wealth Together

Partner with Rescia Properties to access proven investment strategies and exclusive multifamily opportunities across thriving U.S. markets.

HOW WE INVEST DIFFERENTLY

Our Investment Approach Is Different — By Design

Many investment firms focus on volume and speed. We focus on precision, discipline, and long-term outcomes. Our strategy is built to outperform across cycles — not just during market booms.

Data-Backed Decisions

We invest based on deep market research, demographic trends, and financial modeling — not assumptions .

Asset Management